Quant Letter: December 2024, Week-3

Weekly (75th Edition)

Surprisingly busy week in quant finance for this time of year! Highlights include new research on generative AI, dynamic hedging, crypto forecasting, investor behavior analysis, and the impact of big data on corporate finance. No newsletter next week. Happy Holidays.

SSRN

Recently Published

Quantitative

Bitcoin Price Forecasting: The new model predicts Bitcoin's price based on factors like institutional adoption and supply shock, emphasizing the role of these factors in Bitcoin's price increase. (2024-12-16, shares: 415.0)

Portfolio Variable Selection: Machine learning methods can choose predictors for optimal portfolio choice, improving portfolio performance and decreasing portfolio risk, leading to high Sharpe ratios. (2024-12-16, shares: 5.0)

Warranty Accuracy: Machine Learning vs Human Estimates: Machine learning models have been found to be more accurate than human experts in predicting warranty provisions in accounting due to human errors like aggregation bias and historical cost anchoring. (2024-12-14, shares: 4.0)

Monetary Policy Impact: The study reveals that companies with access to big data adjust their capital investment more in response to monetary policy shocks, especially if the data feedback loop is strong. (2024-12-16, shares: 6.0)

Cryptocurrency Arbitrage Trading: The paper offers advice on creating a high-frequency trading system that capitalizes on arbitrage opportunities in the cryptocurrency market. (2024-12-14, shares: 3.0)

Updating Online Reviews: The study observes the review updating phenomenon where consumers alter their existing reviews, demonstrating that updates usually lessen the severity of the review ratings and content. (2024-12-12, shares: 130.0)

Corporate ESG Narrative Transmission: The study uses Latent Dirichlet Allocation and the XGBoost algorithm to predict the link between the topics in ESG reports and the investment decisions of institutional investors, providing guidance for institutional investors and corporations. (2024-12-16, shares: 6.0)

Financial

Portfolio Optimization with GOPALS: The traditional method for portfolio optimization is prone to errors, resulting in suboptimal portfolios, and current techniques fail to fully address these issues. (2024-12-14, shares: 3.0)

Investor Types & Asset Price Comovement: The study suggests that asset price comovement can significantly change if an investor type expands their investment universe due to an external shock. (2024-12-15, shares: 3.0)

Generative AI in Financial Info Processing: The paper shows that nearly half of retail investors use generative AI for financial information processing, with more advanced investors utilizing it more effectively. (2024-12-12, shares: 3.0)

Iterated Combination Method for Risk Measure Forecasting: The study introduces an innovative technique, iterative combination, for forecasting Value-at-Risk and Expected Shortfall, proving it to be more effective than traditional methods. (2024-12-16, shares: 10.0)

Index Inclusion and Corporate Actions: Inclusion in a stock index increases market attention, influencing company investments and stock-based management pay, with companies investing more to minimize shareholder losses and reduce management compensation risk. (2024-12-13, shares: 2.0)

Recently Updated

Quantitative

Dynamic FX Hedging: Dynamic foreign exchange hedging strategies, considering factors like trend and interest rate differential, can improve returns and manage risk better than static ones. (2024-12-05, shares: 41.0)

SP 00 Volatility: Simple volatility forecasts can stabilize volatility as effectively as complex models, enhancing stock market investment strategies. (2024-11-06, shares: 6.0)

ML Forecasting for Investments: The MLAGRUPPO model, combining machine learning and attention mechanism, can improve stock risk prediction and intelligent investment decision-making. (2024-12-05, shares: 11.0)

Mutual Fund Redemptions: Mutual fund investor redemptions can reduce the liquidity of their equity holdings, with investor sentiment and stock returns being factors that negatively affect liquidity. (2024-11-21, shares: 6.0)

Fundamental and Non-Fundamental Volatility in GCC Stock Markets: The study analyzes the factors influencing stock price fluctuations in Gulf countries, focusing on the role of oil prices. (2024-10-21, shares: 2.0)

Financial

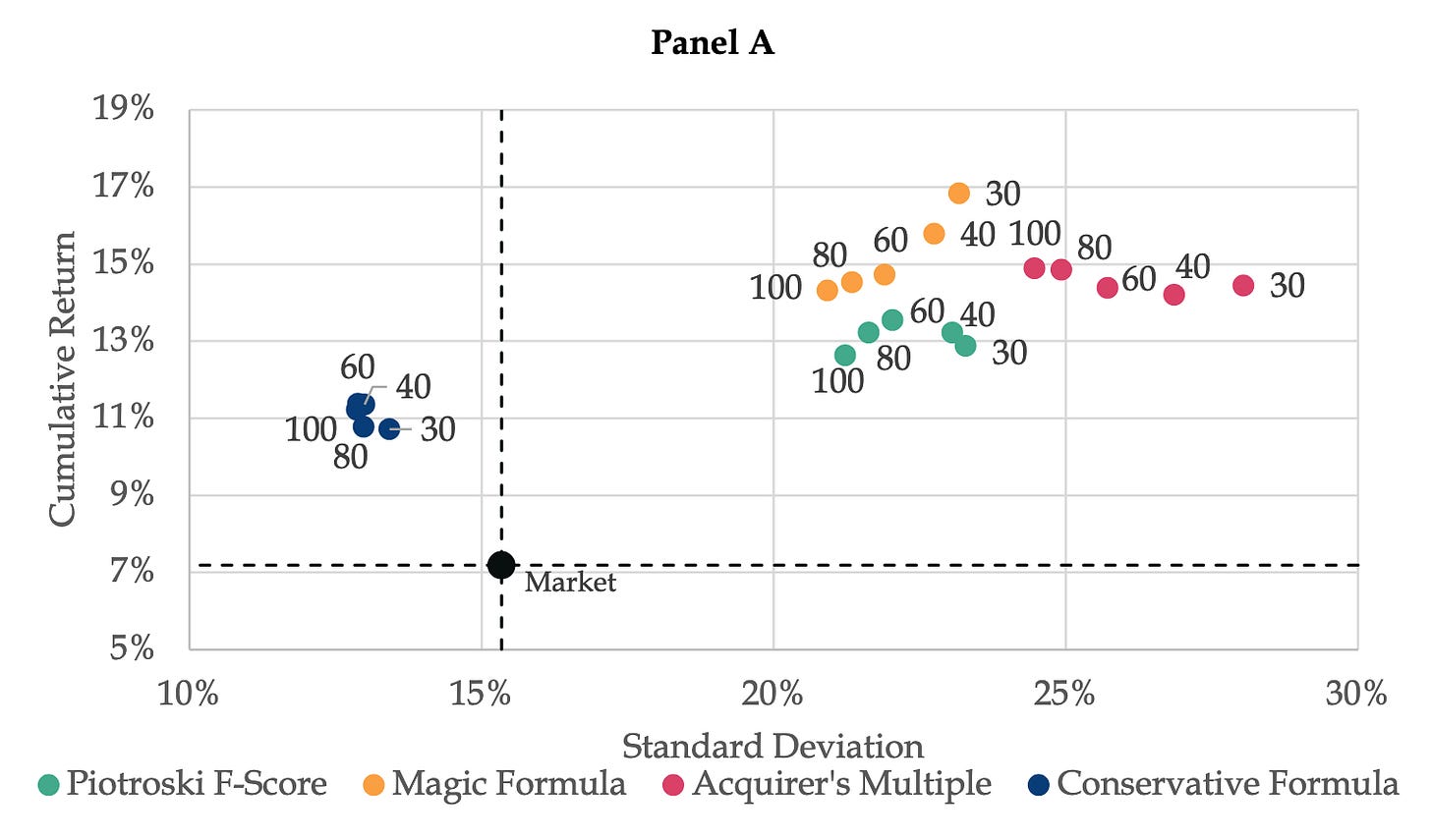

Formula Investing: The research compares four investment strategies, finding that none consistently outperforms the others and that their effectiveness has declined since 2000. (2024-12-03, shares: 570.0)

Stock Returns: The study uses over a thousand machine learning models to predict stock returns, finding that design choices significantly affect predictions, with nonstandard error being 59% higher than standard error. (2024-11-23, shares: 12.0)

Sturm-Liouville Theory: The paper introduces a new approach to applying SturmLiouville theory in quantitative finance, offering innovative methods for spectral decomposition and new applications for credit risk modeling, interest rate derivatives, and portfolio optimization. (2024-12-07, shares: 2.0)

Portfolio Optimization: The research suggests a portfolio optimization method that effectively uses information about the top 500 U.S. stocks, resulting in more stable weights and consistently better performance than value-weighted portfolios. (2023-03-31, shares: 3.0)

Memory in Markets: The paper investigates how memory affects the belief formation of financial market participants, finding significant recall distortions in consensus earnings forecasts of sell-side stock analysts, with analysts over-recalling distant historical episodes and selectively forgetting past positive events. (2024-11-04, shares: 7.0)

Market Beta Assessment: A novel method for comparing market beta estimates to unobserved true betas is introduced, applicable to any beta estimate and requiring few assumptions about the true asset pricing model. (2024-11-07, shares: 5.0)

Event-Driven Connectedness Timing: A study of nearly 900 oil-related events from 1987 to 2022 shows that geopolitical events consistently cause more volatility in energy commodities than economic or natural events. (2024-12-10, shares: 7.0)

DCCS Model Dynamics: The Dynamic Covenant Capital Structure model integrates Debt/EBITDA covenants into capital structure decisions, providing insights into how covenants influence corporate finance policies and helping firms optimize leverage and financial flexibility. (2024-10-22, shares: 2.0)

Hybrid Model Calibration: The calibration of cross asset hybrid models for valuing and simulating exposure of complex financial instruments is explored, with a focus on understanding volatilities and correlations of interest and exchange rates. (2024-11-22, shares: 3.0)

Overconfidence and Trading Volume: A study finds a strong positive correlation between investor overconfidence and trading volume, indicating that overconfident investors tend to trade more, even when advised otherwise. (2024-11-18, shares: 2.0)

Fraud and Financial Health: Accounting fraud significantly exacerbates financial distress among individuals exposed to it, with uninformed financial decisions made prior to fraud revelation increasing individuals' financial distress post revelation. (2024-12-10, shares: 17.0)

ArXiv

Finance

OU Pairs Trading: A preliminary study shows that a pairs trading strategy using the Ornstein-Uhlenbeck process captures trends but underperforms due to non-stationary pairs and parameter tuning limitations. (2024-12-17, shares: 8)

Deep Covariance Forecasting: A new method for forecasting asset return covariance matrices using a Riemannian-geometry-aware deep learning framework outperforms traditional methods by considering the geometric properties of the matrices. (2024-12-12, shares: 8)

PolyModel Hedge Fund Portfolios: The use of machine learning and PolyModel feature selection in hedge fund investments improves returns and portfolio optimization, but also increases volatility, questioning the reliability of larger funds. (2024-12-15, shares: 6)

Deep Factor Residuals Trading: A replication of the Deep Learning Statistical Arbitrage methodology on recent U.S. equity data shows strong performance, suggesting potential overfitting, specific market conditions, or insufficient accounting for transaction costs and market impact. (2024-12-16, shares: 5)

Interbank Market Analysis: The research explores the interdependence of banks in financial networks, revealing that smaller banks withdrew from high-value trades during the financial crisis. (2024-12-13, shares: 5)

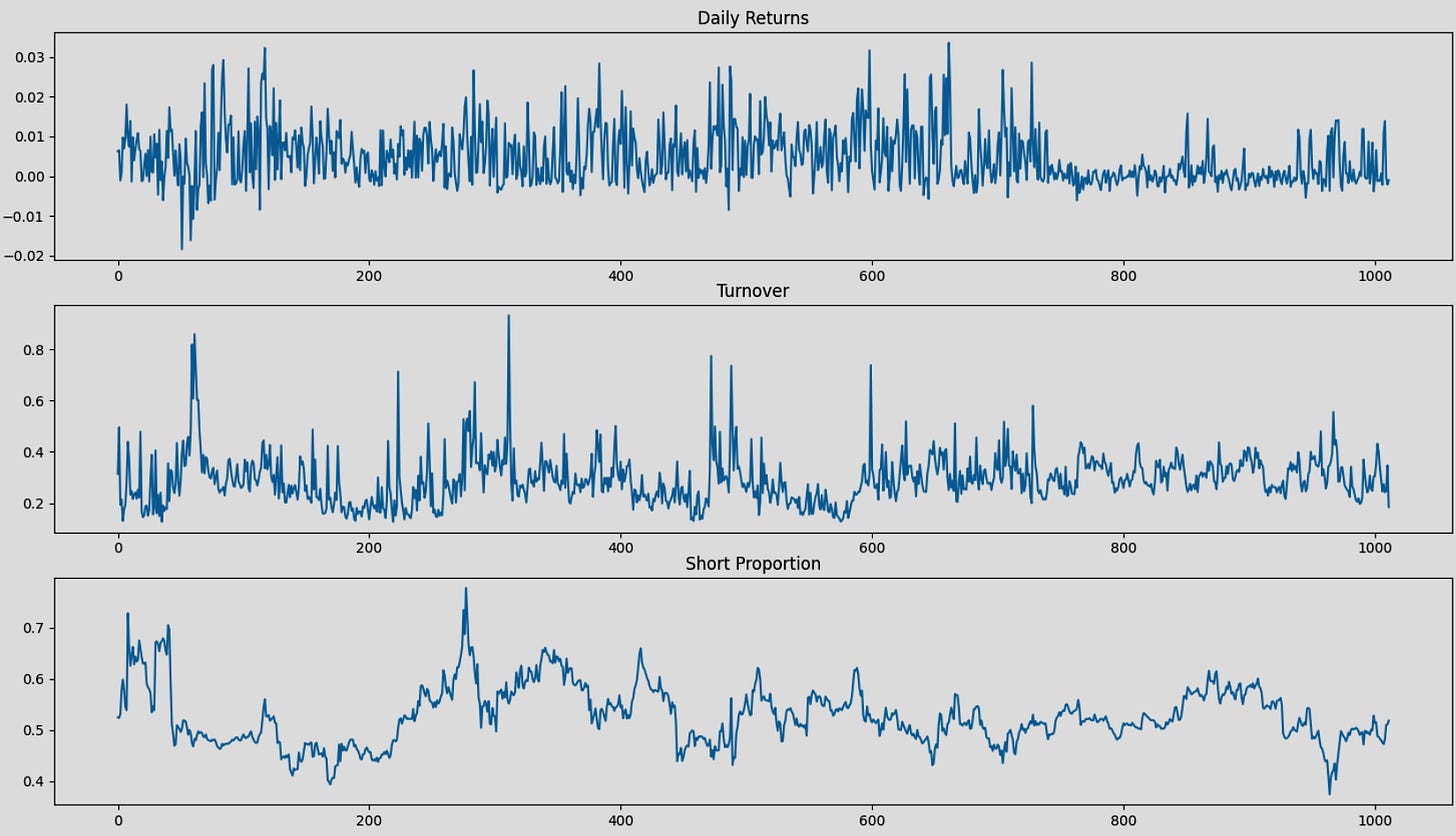

Market-Neutral Strategy: The report outlines a market-neutral investment strategy for NYSE equities, demonstrating superior performance with risk parity. (2024-12-16, shares: 4)