Quant Letter: December 2025, Week-2

114th Edition

ArXiv

Finance

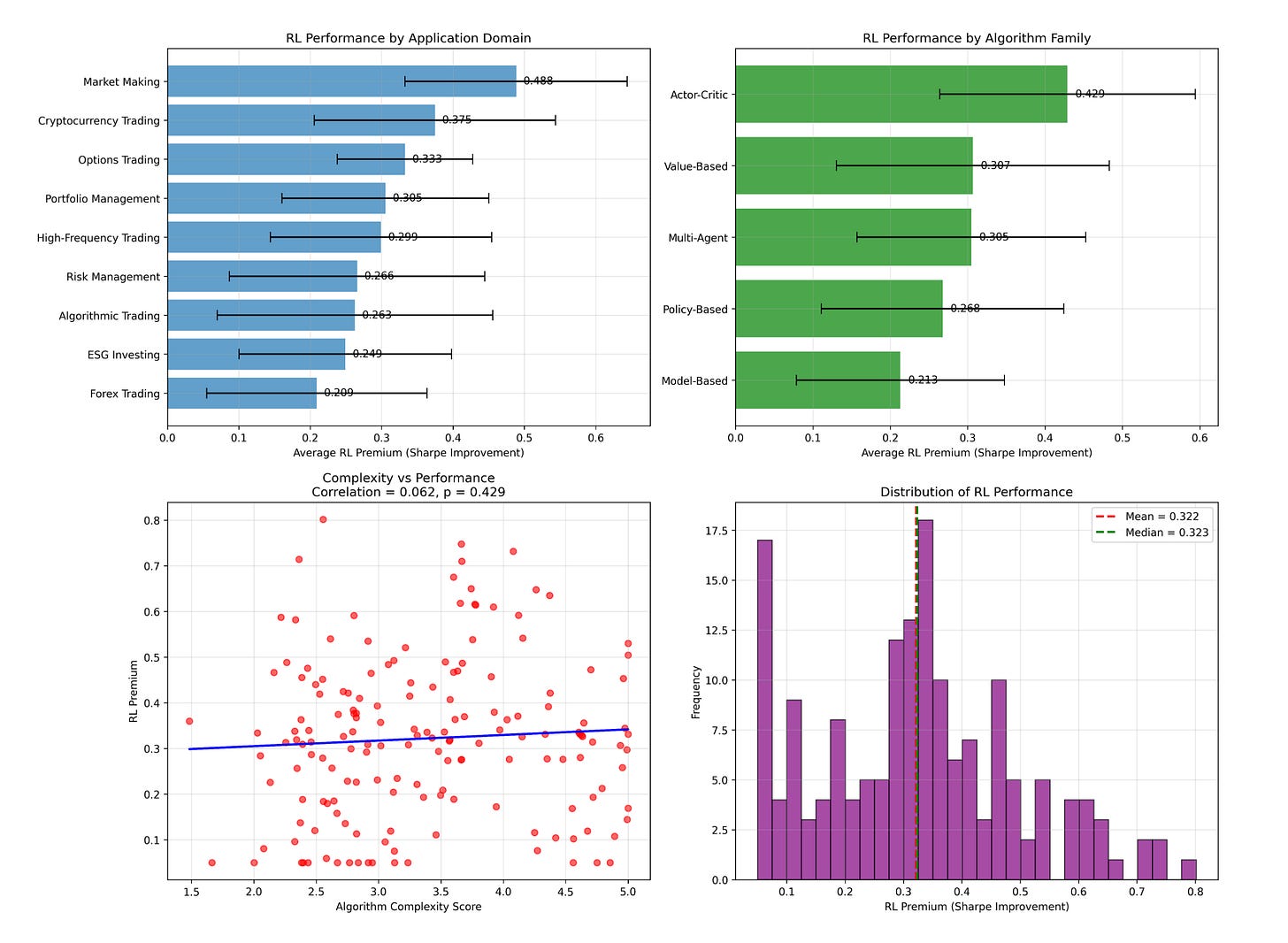

RL for Financial Decisions: Reinforcement learning improves financial decision-making by simplifying complex investment problems, emphasizing clear explanations and strong reliability over complex algorithms. (2025-12-11, shares: 2)

Unified Risk-Neutral Pricing: The paper presents a new approach to pricing zero-coupon bonds that aligns them w…