Quant Letter: January 2025, Week-4

Weekly (78th Edition)

ArXiv

Finance

Realistic Limit Order Book Simulation: The MDQR model, an advanced Queue-Reactive model, uses neural networks to understand complex market dependencies, making it useful for practical applications like strategy creation. (2025-01-15, shares: 16)

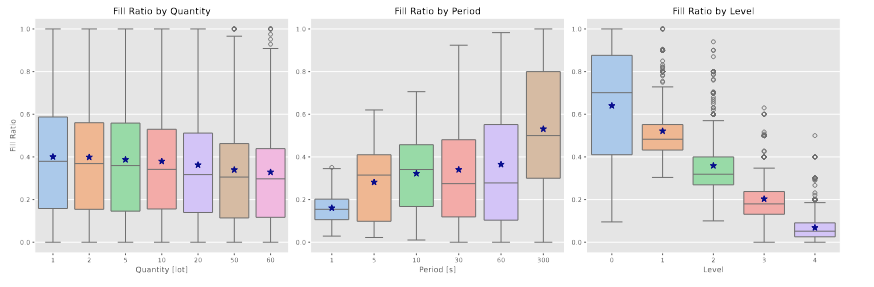

Liquidity Spread Estimation: The article introduces a model that uses option theory to calculate l…