Quant Letter: July 2023, Week 4

Weekly quantitative finance newsletter

Engaging Research

Transfer Learning for Portfolio Optimization

Pretty interesting paper looking at the performance enchancement coming from transfer learning (ml technique to train models on external but related data). They specifically look at cross-continent, cross-sector, and cross-frequency transfers. Fig two, below shows the Sharpe ratio and transfer risk when transferring from the US market to other markets. They ran a bunch of other experiments.

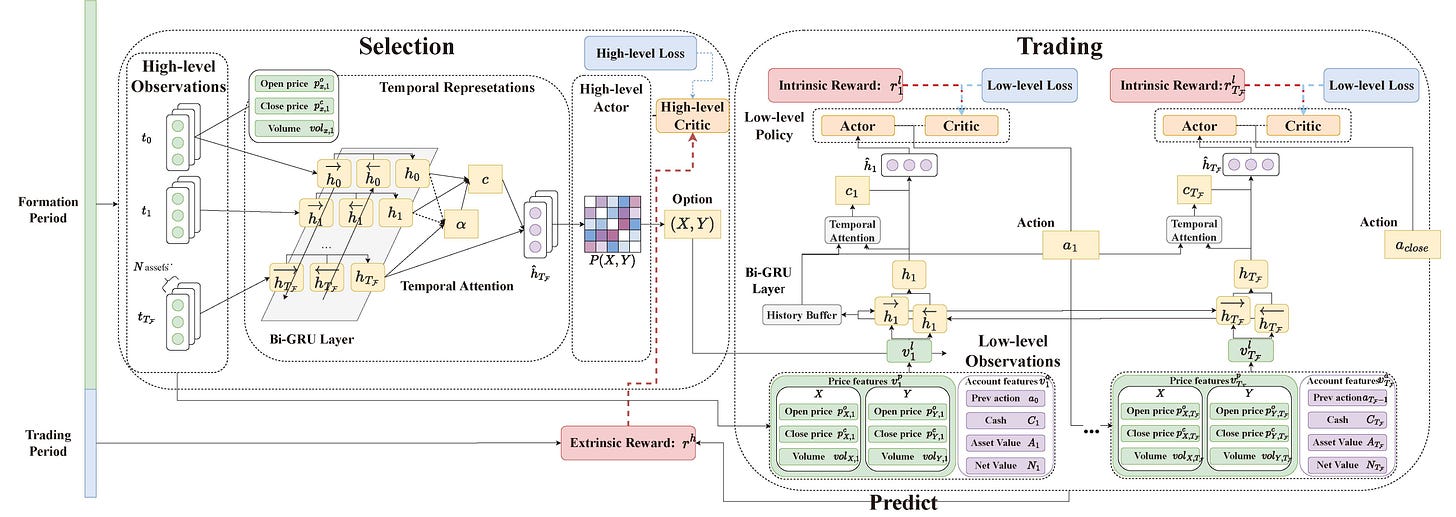

If we can automate execution, hedging, and portfolio management using reinforcement learning, why not do the same for pairs trading strategies. This code is backed up by a paper (click title for code) which goes into the details of their hierarchical reinforcement learning strategy.

Decomposing Downside Investment Risk: CES

Caught a paper with zero downloads from BNP Asset Management: “Some asset managers propose switching to value-at-risk (VaR) or expected shortfall (ES) as risk measures.”

“We argue that the traditional asset management industry should, as a rule, ‘not’ apply ES directly. Instead, expected portfolio return should be first subtracted from it; this ‘Centred Expected Shortfall (CES)’ forms anatural extension of volatility.”

CDS Volatility as Economic Uncertainty Indicator:

This research proposes using the volatility of sovereign credit default swaps (CDS) as a measure of economic uncertainty, indicating that fluctuations in these CDS spreads.

I like the use of these impulse responses they communicate the message well. The use a Bayesian panel vector autoregression to assess the macroeconomic responses to uncertainty shocks.

Around 60 additional SSRN, ArXiv, RePec, and GitHub links and summaries follow below.