Quant Letter: June 2025, Week-2

Weekly (95th Edition)

SSRN

Recently Published

Quantitative

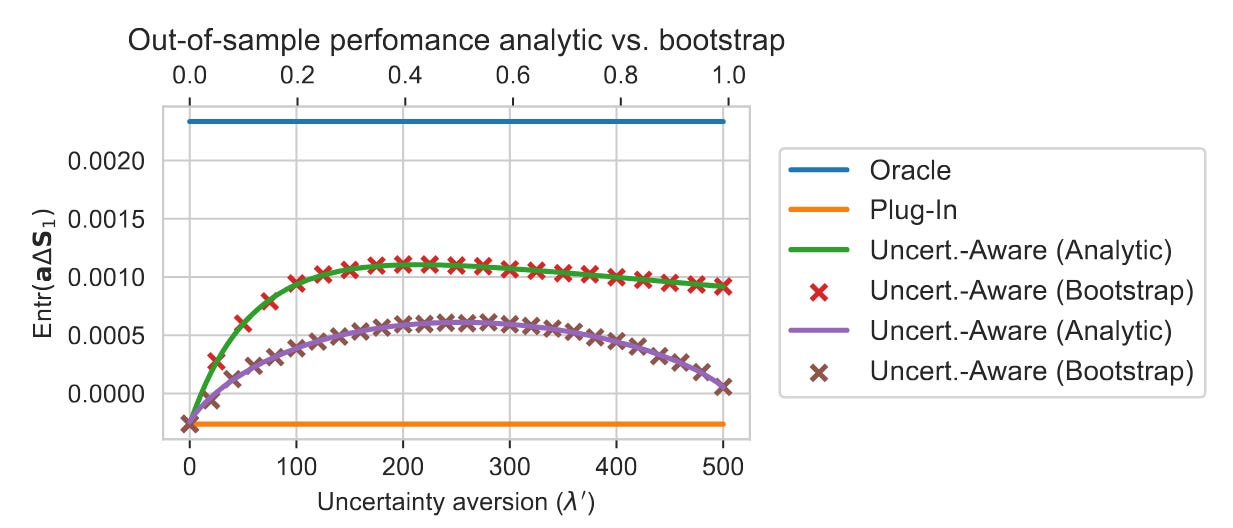

Financial Optimization Strategies: The paper suggests a new approach to handle model uncertainty in quantitative finance, proposing an ad hoc subsampling strategy when a natural model distribution is absent. (2025-06-08, shares: 2.0)

Deep IV Factor Models: The Deep Implied Volatility Factor Model, combining neural networ…