Quant Letter: March 2025, Week-1

Weekly (81st Edition)

ArXiv

Finance

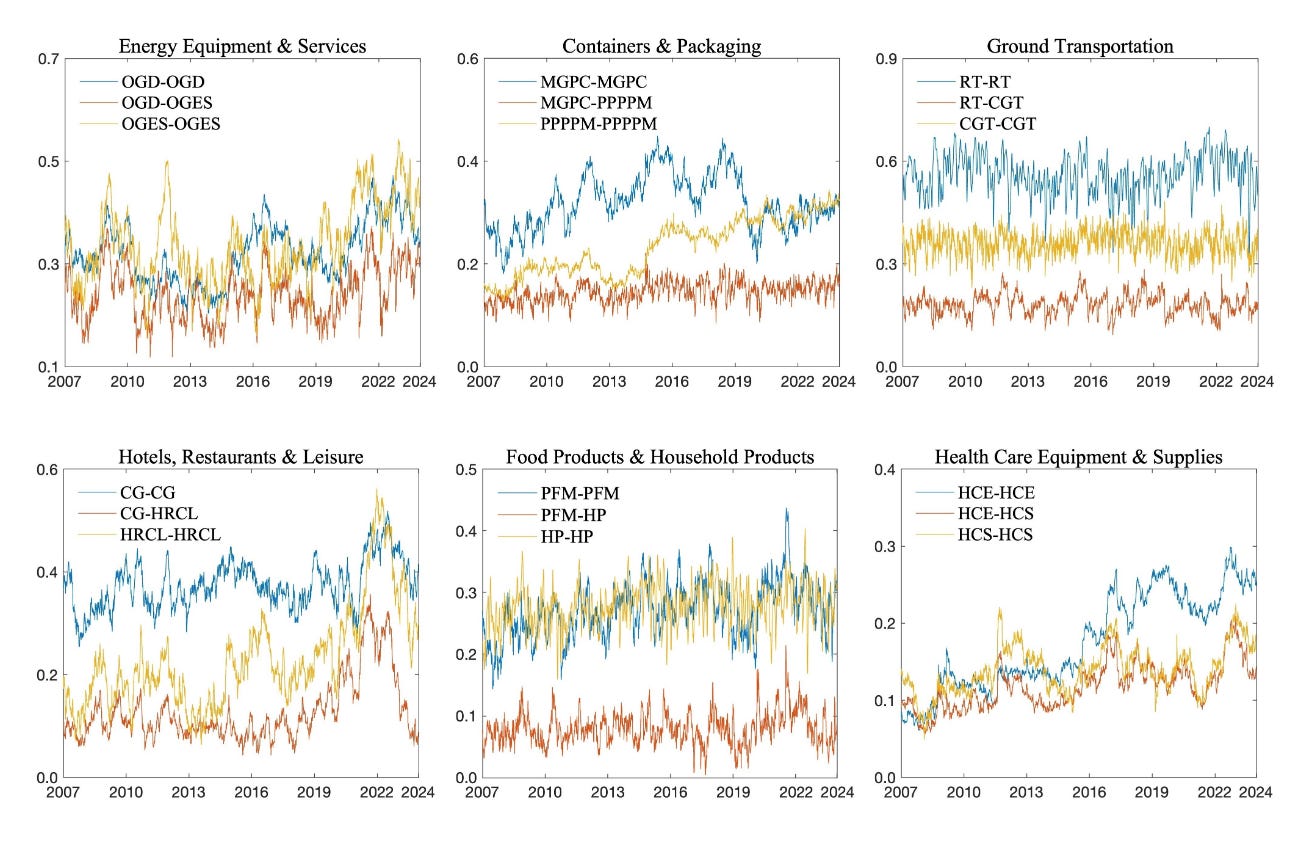

Factor Correlation Model: A new model with a unique variation-free parameterization of factor loadings shows adaptability and scalability in both small and large asset return environments. (2025-03-03, shares: 11)

Commodity Futures Structure Interpretation: The article introduces signature perturbations as a way to explain the success of sign…