Quant Letter: May 2024, Week-3

Weekly (46th Edition)

Quants have been busy this week! From the 100+ links this week, I eyeballed 20 innovative research pieces. Enjoy finding them.

SSRN

Recently Published

Quantitative

Hedge Fund Default Risk: The article explores the difficulties in determining the price and risk of hedge fund securities due to a disconnect between margin call defaults and default probability models. (2024-05-11, shares: 4.0)

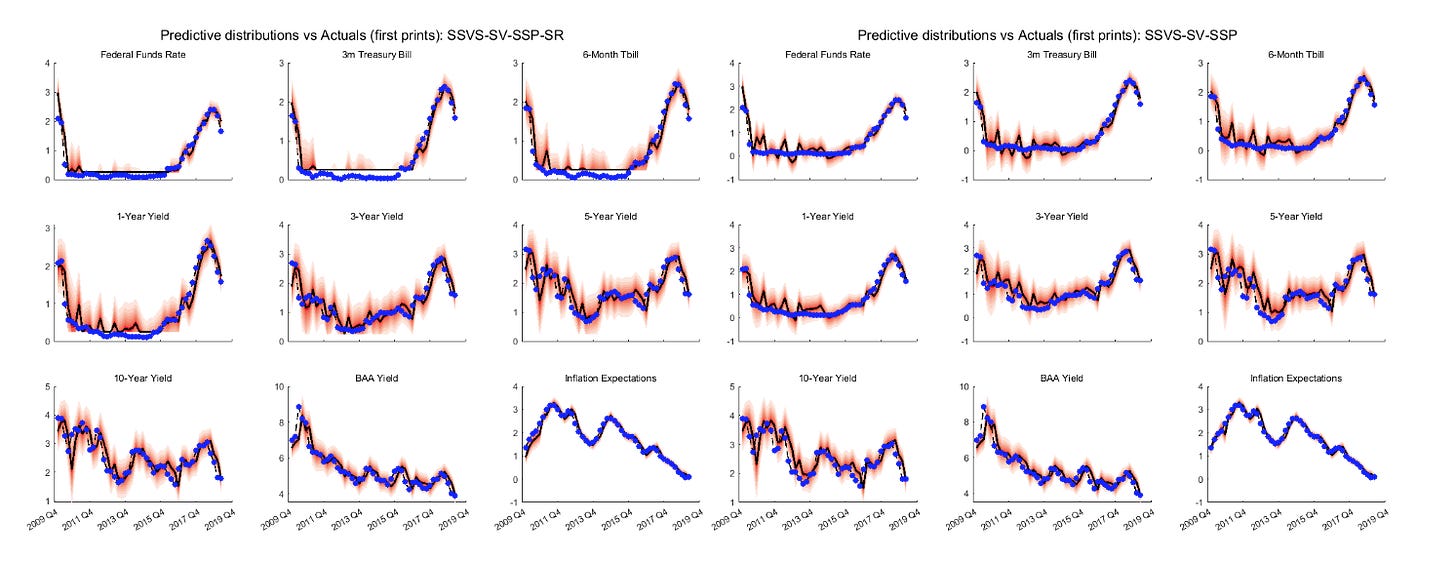

Forecasting Shadow-Rate VARs with ML: The article examines the use of Shadow Rate Vector Autoregressions in macroeconomic forecasting, particularly the effects of shrinkage priors. (2024-05-14, shares: 3.0)

Temporal Kolmogorov-Arnold Networks: The article presents Temporal Kolomogorov-Arnold Networks (TKANs), a new neural network design that merges the benefits of Recurrent Neural Networks and Long Short-Term Memory for improved multistep time series forecasting. (2024-05-12, shares: 2.0)

Common Advisor Effect in Allocations: The study reveals that pension funds with the same asset manager or actuary tend to make similar asset allocation decisions, which may not align with their unique characteristics or sophistication level. (2024-05-09, shares: 3.0)

Computational Legal Studies Transformation: The article reviews the application of computational analysis techniques in empirical legal scholarship, emphasizing recent advancements in large language models and generative AI. (2024-05-13, shares: 2.0)

Financial

Intraday Momentum Strategy: The study investigates the success of an intraday momentum strategy on SPY, an ETF tracking the SP500, which resulted in a 1985 total return from 2007 to 2024. (2024-05-10, shares: 1012.0)

FX Margin Trading Biases: A Japanese FX market survey shows that behavioural biases greatly affect the performance of over 1300 private investors, indicating that addressing and altering these biases can enhance investment results. (2024-05-09, shares: 7.0)

Foreign Signals and Stock Prices: Machine learning algorithms can predict daily U.S. stock returns based on foreign market signals, with a portfolio based on these predictions yielding abnormal returns of 5.77 basis points daily. (2024-05-09, shares: 15.0)

Derivatives Optimization: The article presents a new type of portfolio optimization that considers parameter uncertainty in portfolios with derivatives, utilizing the Exposure Stacking method. (2024-05-14, shares: 2.0)

Liquid Factor Models: The author recommends using liquid instruments in factor models, arguing that they are more transparent, tradeable, and can surpass other factors while lowering hedging expenses. (2024-05-09, shares: 7.0)

Decentralized Options Trading: The research looks at OnChain options traded on a decentralized Ethereum blockchain exchange, underlining the differences in implied volatilities compared to OffChain options traded on centralized exchanges. (2024-05-09, shares: 3.0)

Inflation and Investor Response: Research indicates that investors often hold unrealistic expectations about stock returns during high inflation, and lack knowledge about inflation-hedging strategies, affecting their trading decisions. (2024-05-09, shares: 14.0)

Bank Performance Factors: A new bank performance metric reveals that structural issues like cost inefficiencies primarily cause underperformance, with high-performing banks being less dependent on government aid and more shock-resistant. (2024-05-09, shares: 4.0)

Portfolio Risk Measure: A novel portfolio measure of risk-adjusted excess returns is introduced, which views any negative impact on compound return as risk, addressing some criticisms of the Sharpe ratio. (2024-05-10, shares: 7.0)

Stock-Based Compensation Valuation: The study introduces a closed-form approximation for the fair value of market-based awards and SPAC transactions, providing a strong alternative to Monte Carlo simulation methods. (2024-05-11, shares: 4.0)

Recently Updated

Quantitative

Race Discrimination in Hedge Funds: Despite delivering higher returns, minority-operated hedge funds attract less capital, indicating racial discrimination in asset management. (2022-04-08, shares: 373.0)

Bayesian Inflation Uncertainty: Using a Bayesian framework, the study finds that trade openness, COVID-19, and the Ukraine crisis increase inflation volatility in G20 countries. (2022-12-16, shares: 2.0)

Reserve Currency: The article suggests a model that links global recessions to increased demand for U.S. safe bonds, strengthening the dollar and boosting U.S. wealth and consumption. (2024-05-01, shares: 2.0)

Stock Price: The study identifies recency, cluster, and sign as three factors shaping investors' risk perceptions of a stock, influencing trading volume and future volatility. (2024-03-13, shares: 3.0)

Investment Bank Isolation: The article explores the expansion of modern banks into proprietary trading, private equity, and hedge fund services. (2023-04-26, shares: 2.0)

Financial

Machine Learning for Trading: Machine learning is being used to explore the link between high-frequency trading and financial market trends, offering new ways to identify different trading strategies and their effects on market information. (2024-04-01, shares: 3.0)

Network Beliefs Impact Prices: A new model suggests that asset prices are influenced by network properties and investor performance, which can explain price bubbles and fluctuations. (2022-02-17, shares: 167.0)

Macroeconomic Announcements and Pricing: Machine learning has improved the prediction of stock returns, with a model that combines data from different trading days proving more accurate than others. (2024-02-25, shares: 5.0)

Mutual Fund Managers and Volatility: Research shows that mutual fund managers reduce market exposure during times of high market volatility, indicating a sensitivity to market volatility changes. (2022-10-06, shares: 2.0)

CoTrading Networks in US Markets: A study examines how simultaneous trading across different stocks influences US equity market structures and stock prices, introducing a new method to create dynamic stock networks and showing a positive correlation between low-latency co-trading and return covariance. (2023-02-23, shares: 2.0)

Stock-Bond Correlation: The study discusses the significance of stock-bond correlation modeling in portfolio allocation, emphasizing the current preference for negative correlation due to its risk reduction during equity market distress. (2024-04-29, shares: 3.0)

Social Media Trading Impact: The paper investigates the effect of presidential tweets on equity markets, revealing that market volatility increases and liquidity worsens more quickly during extended trading hours. (2021-09-10, shares: 2.0)

Margin Models for MBS: The article delves into the challenges of modeling for mortgage-backed securities trading, including housing market dynamics, changes in mortgage regulations, and government interventions. (2024-05-01, shares: 5.0)

Bond Portfolio Optimization: The research compares the effects of integrating credit risk and interest rate risk in bond portfolio optimization with traditional risk measures, introducing a new approach called Duration Spread Ratio (DSR) optimization that outperforms in all scenarios. (2024-04-14, shares: 2.0)

Earnings Forecast Accuracy: The study examines the link between model-based earnings forecast accuracy and portfolios sorted on implied cost of capital, highlighting that machine learning models provide the highest return spreads and the importance of considering transaction costs in financial analysis. (2024-03-14, shares: 2.0)

ArXiv

Finance

DRL for Put Option Hedging: The article discusses a study that shows deep reinforcement learning (DRL) is more effective than traditional methods for hedging American put options, especially in real-world situations. (2024-05-10, shares: 7)

Noarbitrage in Financial Markets: The paper presents a framework for continuous-time financial market models, demonstrating that no-arbitrage conditions apply in continuous time if they apply in discrete time, and super-hedging prices are the same in both times. (2024-05-10, shares: 5)

Trade Execution in Markovian Environment: The paper investigates a trade execution game for two large traders in a price impact model, showing that the execution strategy is dynamic and reflects various characteristics seen in financial markets. (2024-05-12, shares: 3)

Dynamic Risk Measure: The article presents a revised version of the fundamental theorem of asset pricing in financial market models, demonstrating that all risk-hedging prices are consistent under the NA condition. (2024-05-10, shares: 3)