ArXiv

Finance

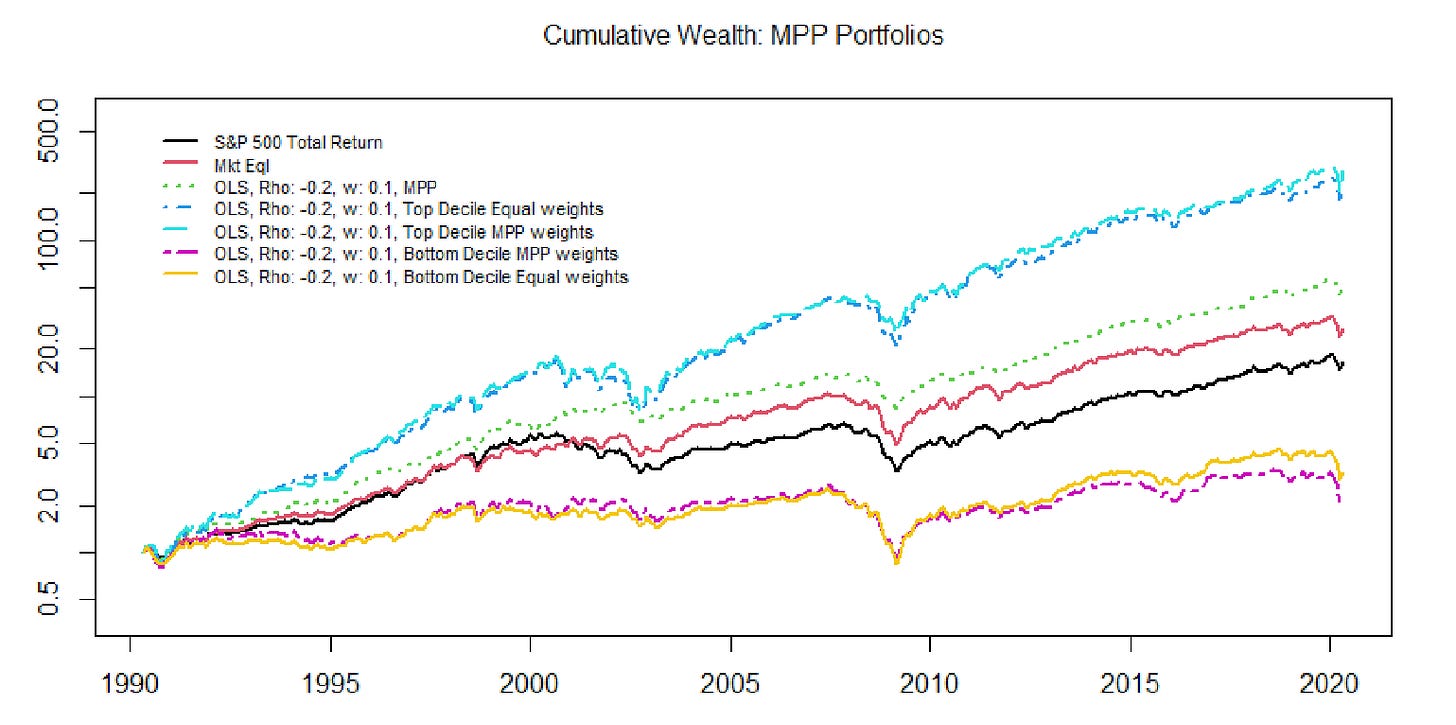

Maximizing Portfolio Predictability with Machine Learning: Portfolio Predictability Maximization using ML: A stock portfolio called the maximally predictable portfolio (MPP), created using machine learning and a Kelly criterion strategy, consistently performs better than the benchmark. (2023-11-03, shares: 5)

Keep reading with a 7-day free trial

Subscribe to Machine Learning & Quant Finance to keep reading this post and get 7 days of free access to the full post archives.