Quant Letter: November 2024, Week-2

Weekly (70th Edition)

ArXiv

Finance

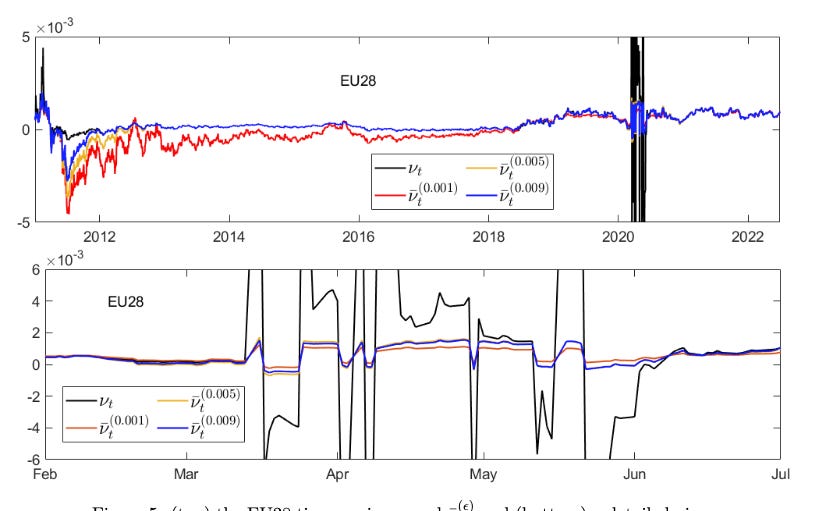

Estimating Shadow Rate: The research introduces a computational method to calculate the shadow riskless rate (SRR) in a risk-free market, which can help differentiate between investment asset classes. (2024-11-11, shares: 3)

AIAgent Collaboration in Investment Analysis: The study suggests a multi-agent system for financial investment research…