SSRN

Recently Published

Quantitative

Deep RL for Portfolio Allocation: Someone worked 4 -years on this thesis, so that you can read it in 4-hours. No downloads yet, but I am sure it would have some soon. The thesis shows that deep reinforcement learning (DRL) is indeed a good approach to portfolio allocation, enhancing existing methods by better adapting to market conditions. (2023-10-12, shares: 2.0)

Scale in Active Management: The study suggests that previous research significantly overestimates the diminishing returns of mutual funds when considering additional institutional assets managed under the same strategy. (2023-10-11, shares: 3.0)

Machine Learning & the Re-Enchantment of the Admin State: The article discusses the conflict between the use of complex machine learning algorithms in administrative decisions and the need for explanation in administrative law, hinting at possible systemic impacts. (2023-10-09, shares: 2.0)

Computation of Censored LAD Estimator for Panel Data: The article shows that the computation of the censored least absolute deviations estimator for Panel Data can be done by redefining the estimation problem as a Mixed Integer Programming issue. (2023-10-10, shares: 6.0)

Financial

Intraday Market Beta Variation in Chinese Stocks: The paper highlights the intraday variation of market beta in the Chinese stock market, noting that growth stocks and stocks with higher leverage or more research coverage have more significant intraday beta variation. (2023-10-10, shares: 2.0)

Patent Portfolios and Valuation Uncertainty: The study analyzes the effect of patent portfolio traits on market-perceived valuation uncertainty, finding that a larger market value increases uncertainty, while more patents and lower value dispersion decrease it. (2023-10-06, shares: 2.0)

Swaption & Volatility Premiums: The research investigates volatility risk premiums in the swaption market, concluding that a strategy that takes on both volatility and jump risks yields a higher Sharpe ratio during periods of low interest rates. (2023-10-10, shares: 3.0)

Commodity Market Liquidity Factors: The research identifies the key factors influencing commodity futures liquidity, with idiosyncratic factors and excess hedging demand having the most impact, and well-funded liquidity providers able to lessen negative effects. (2023-10-11, shares: 2.0)

Crypto

Admin Law Scholars Amici Brief: SEC v. Coinbase: The SEC is taking action against Coinbase Inc. and Coinbase Global Inc., asserting its power to regulate investment contracts in new situations. (2023-10-10, shares: 20.0)

Crypto Liquidity Forecasting: The article introduces an algorithm that uses past transaction data to predict liquidity over a four-hour period, with the LSTM-based algorithm performing better than SARIMAX and TBATS algorithms in unusual situations. (2023-10-08, shares: 2.0)

Stablecoins vs. Money Market Funds: Stablecoins and money market mutual funds have similar reserve asset backing and market microstructure, but stablecoins show larger dispersions from the dollar peg and higher volatility. (2023-09-12, shares: 2.0)

Investment in Virtual Digital Assets Analysis: Digital assets offer higher average returns than equity and commodities, but are more susceptible to short-term external shocks, according to a study. (2022-06-16, shares: 28.0)

Bitcoin Volatility Estimation Model: The study suggests two semi-nonparametric GARCH models for more precise estimation of Bitcoin volatility dynamics, showing their superiority over traditional GARCH models. (2022-03-09, shares: 12.0)

Recently Updated

Quantitative

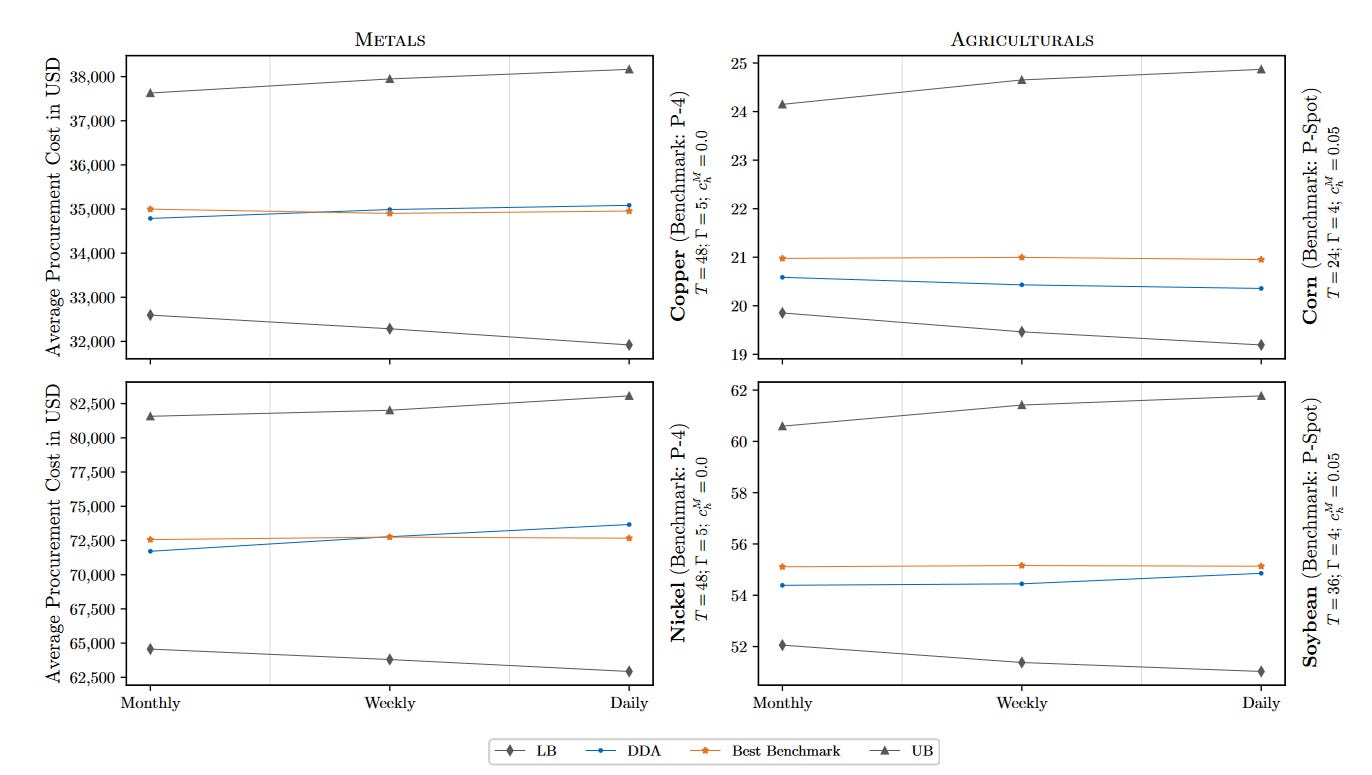

Optimal Commodity Hedging: The paper presents a new procurement policy for data-driven commodity purchasing, combining operational and financial instruments, and tests the policy on real market data of four major commodities. (2021-12-01, shares: 2.0)

Fraud Detection Literature Review: The study introduces a framework for using machine learning in financial statement fraud literature analysis, utilizing bibliometric analysis techniques and topic modeling. (2023-04-19, shares: 3.0)

Privacy-Preserving ML: The tutorial explains how to use machine learning on encrypted data, which is beneficial for managing sensitive personal data under regulations like GDPR. (2023-09-30, shares: 5.0)

Central Bank Communication in Mexico: Predictive Power: The study reveals that Natural Language Processing can predict short-term interest rate decisions based on the communication strategy of Banco de México. (2023-09-08, shares: 3.0)

ESG Factors and Credit Risk of Firms: The study finds a correlation between credit risk and Environmental Social and Governance (ESG) factors using Supervised Machine Learning techniques. (2022-12-19, shares: 2.0)

VIX Index Return Prediction Model: MF-DMA and HAR-RV: The paper introduces a model that uses global trading information of SP 500 Index to predict VIX index return, emphasizing the need for analyzing high-frequency price data globally. (2023-09-10, shares: 2.0)

Financial

The Hidden Rise and Risk of Collective Investment Trusts: The article highlights the growing popularity of collective investment trusts (CITs), an investment vehicle replacing mutual funds in employer-sponsored retirement plans. (2023-09-19, shares: 2.0)

Finance Theories and Big Data: Stock Return Prediction: The article discusses how combining finance theories with big data can improve stock return predictions, with theory-guided models outperforming purely data-driven ones. (2023-09-27, shares: 4.0)

Integrated Framework for Portfolio Optimization: The article introduces a comprehensive framework for portfolio optimization using a neural network, and compares three different problem-solving methods within this framework. (2022-08-21, shares: 3.0)

Global Volatility Surface and Equity Premia Predictability: The article creates a global implied volatility surface using index options from 20 regions, and finds that the surface's convexity can predict global equity premia. (2023-07-25, shares: 2.0)

Bottom-Up Approach to Equity Yield Term Structure: The article offers a new approach to understanding the term structure of market equity yields, showing a positive aggregation effect when using aggregated equity yields of individual firms to estimate the market equity yield curve. (2021-03-02, shares: 2.0)

Bond Fund Industry Concentration and Market Fragility: The article investigates the corporate bond fund industry, concluding that while large funds stabilize the corporate bond market, they also increase the risk to underlying bonds in illiquid markets. (2022-04-27, shares: 2.0)

Timing in Chinese Stock Market: Research shows that predicting returns of the reversal factor's long-short portfolio can yield significant returns in the Chinese stock market. (2023-09-30, shares: 3.0)

Secondary Market Liquidity & the Economy: The Federal Reserve's Secondary Market Corporate Credit Facility improved bond liquidity during COVID-19, but didn't greatly affect capital investment or employment costs. (2023-01-04, shares: 2.0)

ETFs & Illiquid Assets: Fire Sales: A study indicates that ETFs can cause fire sales in illiquid assets, with authorized participants acting as a buffer to prevent such sales. (2021-07-16, shares: 2.0)

Cumulant Risk Premium: A New Methodology: A new method measures the risk premium of higher-order cumulants using leveraged ETFs, showing significant differences across asset classes, especially during stressful times. (2023-01-19, shares: 2.0)

ArXiv

Finance

Quanto Derivatives: Risk Valuation: The article introduces a model that predicts daily electricity prices and average temperatures, offering a way to manage price and volume risks, and includes formulas for derivatives like quanto options. (2023-10-10, shares: 10)

Anomalous Diffusion: Order Book Simulation: The paper expands a numerical method to simulate the spread of financial market orders, showing the price impact of flash limit-orders and market orders, and advocates for non-uniform sampling in diffusive dynamics simulations. (2023-10-09, shares: 8)

Valuation Duration: Stock Market Dynamics: The study reveals that market valuation duration is influenced by limited cash flow information beyond a year and negatively predicts annual market return, outperforming other predictors, suggesting valuation duration is a key variable that enhances the price-dividend ratio in stock-market dynamics. (2023-10-11, shares: 6)

Economics

Data Sharing for Energy Forecasting: Wind Power Analytics Market: The article explores the creation of a market for wind power forecasting analytics that takes into account correlations, using a Shapley value-based policy for revenue allocation. (2023-10-09, shares: 8)

AI's Impact on UK Businesses: No Effect on Labour Productivity: The paper finds no significant effect of AI adoption on labour productivity in UK businesses from 2015 to 2019, based on data from the UK Office for National Statistics. (2023-10-06, shares: 4)

Legal Tender Digital Currency's Impact on China's Monetary Policy: The paper suggests that China should develop a more effective monetary policy while promoting Central bank digital currencies, examining their impact on China's monetary policy and money supply multiplier. (2023-10-11, shares: 4)

Miscellaneous

Sensitivity Analysis in Discontinuous Models: Discontinuous Model Sensitivity Analysis: The article discusses a framework for understanding complex computational models, focusing on discontinuities and discrete input variables, and applies it to risk analysis of compound risk models and reinsurance credit risk. (2023-10-09, shares: 10)

Risk Assessment and Model Selection with Statistical Significance: Statistical Significance in Risk Assessment and Model Selection: The paper presents a framework for evaluating socio-technical risks of foundation models, using a new statistical method and a risk-aware approach, and applies it to assess large language models for risks of deviating from instructions and producing harmful content. (2023-10-11, shares: 7)

Quantum-Enhanced Time Series Forecasting: Quantum-Enhanced Forecasting for Time Series: The study introduces a time series forecasting method, Quantum Gramian Angular Field (QGAF), that merges quantum computing and deep learning to enhance the accuracy of time series classification and forecasting, and validates its effectiveness using major stock market datasets. (2023-10-11, shares: 6)

Historical Trending

Predicting China's CPI with Scanner Data: The study uses supermarket sales data to create a Food Consumer Price Index in China and uses machine learning to predict CPI growth rate, performing better than traditional models. (2022-11-30, shares: 11)

Weighted Average of SP Random Variables: The research suggests that diversifying super-Pareto losses increases portfolio risk, discouraging risk sharing in market equilibrium. (2022-08-17, shares: 170)

Game Theoretical Approach to Derivative Pricing: The study uses game theory and deep multi-agent reinforcement learning to create models that match market prices of specific options, aiding in understanding local volatility and path-dependence. (2022-03-14, shares: 68)

Pricing Multi-Asset Options with Adaptive Quadrature: The article presents a new, efficient method for pricing European multi-asset options that is faster than existing methods. (2022-03-15, shares: 28)

Convergence Rates in Nested Simulation: The paper introduces a new simulation-based method for estimating functionals of a conditional expectation, which helps overcome the issue of dimensionality. (2022-01-09, shares: 16)

Model-Based Latent Causal Socioeconomic Health Index: The article introduces a national LAtent Causal Socioeconomic Health (LACSH) index, combining latent health factor index with spatial and statistical causal modeling to analyze the causal effects on a latent trait with spatial correlation. (2020-09-24, shares: 43)

RePec

Finance

Hybrid Stock Trading Model: A study uses deep learning and basic trading rules to create a quantitative trading strategy, testing its effectiveness with Chinese market data. (2023-10-12, shares: 43.0)

Investor Sentiments and Volatility Trading Strategies: Research examines the link between trader sentiment and market volatility in India during COVID-19, suggesting new options trading strategies considering traders' neuro-specific intentions. (2023-10-12, shares: 32.0)

Intraday Profitability in Algorithmic Trading: A study reveals that algorithmic traders profit while non-algorithmic traders lose, with market volatility causing contrasting trading behaviors. (2023-10-12, shares: 29.0)

Volatility Smile Harvesting: Dynamic Nelson-Siegel Approach: The research assesses the Dynamic Nelson–Siegel approach to modeling volatility smile, demonstrating its superior performance over static models in mean returns and Sharpe ratio. (2023-10-12, shares: 19.0)

fBetas and Portfolio Optimization with f-Divergence Risk Measures: The paper presents a new f-Beta for portfolio optimization, comparing its performance with Standard Beta and Drawdown Betas using selected stocks against the S&P 500 market index. (2023-10-12, shares: 18.0)

Predictive Model Performance in Covid-19 and Russian-Ukrainian War: The study explores the use of artificial intelligence in predicting stock market trends in volatile situations, showing its superior performance over linear regression, particularly after the Russian-Ukrainian war. (2023-10-12, shares: 17.0)

Statistical

Gender Diversity Prediction in Chinese Boardrooms with Machine Learning: A study successfully used machine learning, specifically the XGBoost model, to predict gender diversity on the boards of Chinese publicly-traded companies. (2023-10-12, shares: 22.0)

XGBoost Framework for Fraud Detection in Mobile Payments: A proposed XGBoost-based framework for detecting fraud in mobile transactions was found to be most effective when combined with multiple unsupervised outlier detection algorithms. (2023-10-12, shares: 17.0)

Comparing ML Algorithms for Item Difficulty Prediction: A comparison of machine learning methods for predicting English reading comprehension test difficulty found that elastic net was best for continuous prediction, while random forests excelled in classification tasks. (2023-10-12, shares: 17.0)

Machine Learning

Forecasting Global Stock Market Volatility with GNN Model: The article discusses a study that introduces a new volatility forecasting model for global market indices. This model uses a spatial-temporal graph neural network (GNN) and performs better than existing models in short- and mid-term forecasting, potentially leading to economic benefits for investors. (2023-10-12, shares: 20.0)

Forecasting volatility with machine learning: Panel data approach: Machine learning methods using panel data analysis are more effective in predicting volatility than traditional linear models, according to a study. (2023-10-12, shares: 45.0)

Machine learning in algorithmic investment strategies on global stock markets: Algorithmic investment strategies using machine learning models perform better than passive strategies, with Linear Support Vector Machine and Bayesian Generalized Linear Model being the most effective, research shows. (2023-10-12, shares: 31.0)

ML and Trade Agreements: The article uses machine learning to study the effect of free trade agreement policies on trade flows, concluding that more detailed agreements have a greater impact. (2023-10-12, shares: 22.0)

Machine learning framework for forecasting sales of new products with short life cycles: For predicting sales of short-lived products, simple ARIMAX is more effective than deep neural networks, but DNNs perform well when Gaussian white noise is added, a study finds. (2023-10-12, shares: 26.0)

Predicting Stock Returns with ML: The study applies machine learning to predict stock market returns based on company traits, with results varying depending on company size, recent data availability, and market-specific elements. (2023-10-12, shares: 19.0)

Cross-Market Info and Stock Volatility: The research examines the role of cross-market information flow on China's stock market volatility, finding it significantly aids in medium and long-term forecasts but not short-term volatility. (2023-10-12, shares: 18.0)

ML for ReTakaful Contributions: The article employs machine learning to find the best ReTakaful contributions model for Morocco's Islamic insurance sector, showcasing the algorithms' potential in calculating appropriate contributions. (2023-10-12, shares: 18.0)

GitHub

Finance

Pytimetk: Python's Time Series Toolkit: The toolkit provides various tools for conducting time series analysis in Python. (2021-04-16, shares: 100.0)

TimeSeriesSeq2Seq: Neural Networks for Time Series Forecasting: The repository offers resources for learning and creating sequence-to-sequence neural networks for time series forecasting using Keras and TensorFlow. (2018-05-11, shares: 590.0)

PolicyGradientTradingAlgorithm: Maximizing Sharpe Ratio for Autotrading: The capstone project introduces a deep policy gradient algorithm for automated trading by optimizing the Sharpe ratio. (2019-04-26, shares: 7.0)

Marimo: Python Notebook for Data Exploration and App Deployment: The advanced Python notebook enables users to analyze data, develop tools, and launch applications. (2023-08-14, shares: 115.0)

DRL: Reference Environments for Reinforcement Learning: The collection provides benchmark environments for conducting offline reinforcement learning. (2020-04-12, shares: 1008.0)

Trending

jvector: Embedded Vector Search Engine: The article provides a comprehensive review of JVector, a sophisticated embedded vector search engine. (2023-08-25, shares: 822.0)

dreamgaussian: 3D Content Creation: The article delves into the use of Generative Gaussian Splatting as a method for efficient 3D content creation. (2023-09-27, shares: 1725.0)

foam: VSCode Knowledge Management: The article introduces a new system for managing and sharing personal knowledge within the VSCode environment. (2020-06-19, shares: 14184.0)

easydiffusion: Easy AI Artwork Creation: The article showcases an AI-powered tool that generates artwork from text prompts and images on personal computers. (2022-08-23, shares: 7925.0)

LinkedIn

Trending

Human Element in HFT: Sepp's paper on Risk.net examines the allocation of cryptocurrencies in a multi-asset portfolio, revealing that all four strategies used in the study assign positive weight to Bitcoin and Ether. (2023-10-07, shares: 2.0)

Hardware: The Unsung Hero: A podcast interview with Corey Hoffstein discusses the use of machine learning in quantitative investing. (2023-10-09, shares: 1.0)

FPGA: A Paradigm Shift: The performance of portfolios in a long-short portfolio impacts total leverage and beta, with varying results based on whether the portfolios perform equally well or poorly, or if one outperforms the other. (2023-10-07, shares: 1.0)

Blueprint of a Quantitative HFT Forex Shop: Silahian's article offers a detailed guide on establishing a High-Frequency Trading operation in the Forex market, discussing prime brokerages, hardware, Field-Programmable Gate Arrays, human involvement, and strategies. (2023-10-12, shares: 2.0)

Visionary Mathematicians in AI and Data Science: The article underscores the crucial role of visionary mathematicians in the future of AI, Machine Learning, and Data Science. (2023-10-07, shares: 1.0)

WallStreetBets' Impact on the Market Research: A new study in the Journal of Portfolio Management examines user behavior on the WallStreetBets forum, measures its market impact, and provides a dataset and dashboard for further research. (2023-10-12, shares: 1.0)

Significance of Prime Brokerage: JP. Morgan has introduced its Fusion Securities Services Data Mesh on Snowflake's Financial Services Data Cloud, delivering crucial investment data to investors. (2023-10-11, shares: 1.0)

Informative

NLP and the Financial Sector's ESG Data Gap: The NLP4SF programme at Oxford University suggests that Natural Language Processing (NLP) could help fill the ESG data gap in the financial sector. (2023-10-10, shares: 2.0)

Luis L. Perez's RAG System Presentation at Abu Dhabi ML Meetup: Luis L. Perez's presentation slides from the Abu Dhabi Machine Learning Meetup, containing links to RAG systems code, are now accessible. (2023-10-08, shares: 1.0)

Forecasting CPI Inflation with HRNN: The article introduces a Hierarchical Recurrent Neural Network model that effectively predicts the disaggregated inflation components of the Consumer Price Index. (2023-10-12, shares: 1.0)

Deep Dive into Large Language Models in Climate Communication: A recent study provides a comprehensive evaluation framework for Large Language Models' role in climate communication, outlining their potential and limitations. (2023-10-07, shares: 1.0)

Language Models in Stock Prediction: The discussion revolves around a research paper on ChatGPT-4's ability to predict stock market movements and analyze sentiment. (2023-10-10, shares: 1.0)

Podcasts

Quantitative

Quant Investing: Inflation and the Macroeconomy: Rob Arnott, founder of Research Affiliates, talks about inflation, macroeconomics, and index investing at the Economic Club of Miami. (2023-10-11, shares: 3)

Volatility and Trading in a Faltering Economy with Doug Moglia: Doug Moglia predicts a potential 2021 recession due to the Federal Reserve's monetary policy tightening, suggesting Turkish stocks as a possible investment strategy. (2023-10-09, shares: 16)

The Fab Five Market Trading Sessions: Will McBride and Dmitry Pargamanik explain the purpose of the five equity market trading sessions in a discussion with IBKR’s Jeff Praissman. (2023-10-12, shares: 6)

Deception Abilities in Language Models: Thilo Hagendorff discusses his research on the role of machine psychology in machine learning tasks and explores the potential limitations of machine learning. (2023-10-09, shares: 4)

Related

Lueck: Scientific Investing and Macro Divergences: Marty Lueck, co-founder of Aspect Capital, highlights the significance of hypothesis testing, trend impacts on portfolios, and his role as Research Director in a podcast. (2023-10-06, shares: 4)

ODwyer: Tokens and the Future of Money: Rachel O'Dwyer's book Tokens examines the emergence of digital currencies and the potential consequences of online platforms becoming new banks. (2023-10-08, shares: 3)

Jon Hirtle: Founder of Hirtle Callaghan & Co.: Jon Hirtle talks about the development of the OCIO model, changes in asset allocation, and shares his views on the current investment landscape. (2023-10-11, shares: 4)

Jobs and Geopolitics: Market Impact Analysis: Interactive Brokers' strategists analyze the effects of recent employment reports and geopolitical events on equity and fixed income markets. (2023-10-10, shares: 2)

News

Quantitative

Bloomberg's Portfolio Manager Workspace: Bloomberg has launched Portfolio Manager Workspace, a real-time tool that combines portfolio data with industry information, risk analytics, and liquidity insights. (2023-10-12, shares: 7)

Macro Strategies Boost Hedge Fund Gains: Macro hedge funds saw significant profits in September due to increased volatility, while stocks and bonds suffered major losses, as per HFR data. (2023-10-09, shares: 6)

Patchy Liquidity Impedes Systematic Credit: The inconsistency in liquidity is posing challenges to systematic credit risk management. (2023-10-10, shares: 4)

Twitter

Quantitative

Cleanlab: Data Cleaning and Training with Python: Cleanlab is a Python library that automatically cleans and processes data sets, including outliers and duplicates. (2023-10-10, shares: 3)

Short-Term Reversals in Stock Returns: Industry and FamaFrench Factors: A study indicates that while short-term reversal effect in stock returns has lessened, reversals adjusted for industry and Fama-French factors are still significant. (2023-10-08, shares: 3)

Unprofitable Public Companies: Impact on Equity Valuations: Financial Times reports that half of public companies are not profitable, which could lead to equity valuation problems and fiscal tightening. (2023-10-10, shares: 1)

FX Trading Strategy: Skewness Risk Premium for High Returns: Research suggests that purchasing currencies with a high skewness risk premium and selling those with a low one can yield high returns and Sharpe ratio. (2023-10-06, shares: 1)

Financialization Dissertation: Efficient Frontier Allocation and Cognitive Map: The Art Financialization Dissertation explores the efficient frontier allocation ecosystem cognitive map. (2023-10-06, shares: 1)

Miscellaneous

Massive TS Benchmark Introduced in New Forecasting Paper: The article introduces a new benchmark for timeseries forecasting and two new model architectures, pointing out issues with popular models like DeepAR LSTM. (2023-10-12, shares: 0)

Social Media Impact on Wall Street Bets: The article discusses the influence of the Wall Street Bets social media movement on the financial market. (2023-10-12, shares: 0)

McKinsey's Python DataViz Library: Vizro: McKinsey has launched Vizro, a new open-source Python library for data visualization, according to the article. (2023-10-08, shares: 0)

Internal World Models and Language Models: The article presents a study showing that language models have an internal world model and a sense of time, as evidenced by a map found in Llama2's activations. (2023-10-06, shares: 0)

Bitcoin Market Impact and Intraday Dynamics Explored in Paper: The article examines the impact of the Bitcoin market, with a focus on limit order book (LoB) and intraday dynamics. (2023-10-06, shares: 0)

Blogs

Quantitative

Mean Reversion and Momentum Strategy Combination: The article explores the use of mean reversion and momentum strategies together in arbitrage trading to maximize benefits. (2023-10-10, shares: 13)

Diversified Arbitrage Approach Creation: The article investigates the merging of mean reversion and momentum strategies in arbitrage trading for a more varied approach. (2023-10-10, shares: 13)

ADX Trading Strategy with Indicator Backtesting: The article outlines rules and provides an example for the optimal ADX trading strategy using the Average Directional Movement Index Indicator. (2023-10-09, shares: 4)

Williams R Trading Strategy with Indicator Systems: The piece analyzes the Williams Percent Range and RSI Indicator systems within the context of the Williams R Trading Strategy. (2023-10-11, shares: 2)

Related

Supertrend Strategy: Groette's article offers an in-depth review of the Supertrend Indicator Trading Strategy, detailing its backtest settings, formula, and performance. (2023-10-09, shares: 2)

CCI Strategy: The piece on quantifiedstrategies.com outlines the CCI Trading Strategy, including its backtest, indicator settings, rules, and an example. (2023-10-09, shares: 2)

Put Call Ratio Strategy: The Put Call Ratio Trading Strategy is examined on quantifiedstrategies.com, discussing its effectiveness, backtest rules, and settings. (2023-10-09, shares: 2)

Best Indicators: The article provides a comprehensive guide to the best trading indicators, detailing the most frequently used technical indicators and strategies. (2023-10-09, shares: 2)

Parabolic SAR Strategy: Quantifiedstrategies.com's article delves into the Parabolic SAR Trading Strategy, including its backtest. (2023-10-09, shares: 2)

Reddit

Quantitative

Dutch Trading Firms: Expansion Assistance: The author is looking for suggestions to increase their Rotterdam trading companies list. (2023-10-07, shares: 15.0)

Education, Early Career, and Hiring Advice Megathread: The post is a weekly discussion thread providing consolidated information and guidance for budding quants. (2023-10-09, shares: 7.0)

Machine Learning in Finance Review: The author is seeking reviews on a particular book before deciding to invest in it. (2023-10-07, shares: 3.0)

Actuarial to Quant: UK Salary and Feasibility: The author is exploring the feasibility and potential income of shifting from an actuarial to a quant role in the UK. (2023-10-06, shares: 9.0)

Rising

Near Term Trading Thoughts: The author plans to develop a school project centered on short-term trading and position sizing strategies. (2023-10-07, shares: 3.0)

Chaos Theory and Realistic Pricing Options: The article explores the use of Chaos Theory in market pricing, questioning the traditional belief in randomness. (2023-10-09, shares: 0.0)

Attractive Compensation Worldwide for Quants: The article emphasizes that professionals in quantitative finance are highly paid worldwide, unlike in many other sectors. (2023-10-09, shares: 34.0)

Paper with Code

Trending

AutoGen: NextGen LLM Applications with MultiAgent Conversation: AutoGen is an open-source platform designed for creating LLM applications that allow multiple agents to work together to accomplish tasks. (2023-10-08, shares: 6785.0)

StanfordNLP DSPy: Self-Improving Pipelines for Language Model Calls: The machine learning community is exploring techniques for prompting language models and layering them to tackle complex tasks. (2023-10-07, shares: 3401.0)

AutoAgents: Automatic Agent Generation: AutoAgents is a new system that creates and manages multiple AI agents to form a team for different tasks. (2023-10-06, shares: 388.0)

Decoding Speech Perception: A breakthrough in decoding perceived speech from noninvasive recordings could allow interpretation of language from brain activity without surgery. (2023-10-07, shares: 138.0)

Language Models: Space and Time Representation: The capabilities of large language models (LLMs) have led to debates on whether they simply learn superficial statistics or a comprehensive model of the data generating process. (2023-10-07, shares: 121.0)

MultiView Reasoning: Math Word Problem Solving: To solve math word problems, accurate reasoning about quantities in the text and reliable equation generation are required. (2023-10-06, shares: 105.0)

Rising

Language Models vs Human Reviewers: A Comparative Analysis: The first article analyzes the comparison between feedback from GPT4 and human reviewers in scientific publications. (2023-10-07, shares: 72.0)

Improving AI Transparency through Representation Engineering: The second article delves into representation engineering, a field aiming to enhance AI transparency through cognitive neuroscience insights. (2023-10-06, shares: 61.0)

Unifying Reasoning, Acting, and Planning in Models: The third article highlights the shortcomings of large language models in decision-making tasks and their lack of autonomy. (2023-10-10, shares: 60.0)

Enhancing RolePlaying Abilities: Large Language Models (LLMs) have improved roleplaying tasks by enabling models to imitate various characters. (2023-10-06, shares: 55.0)

Benchmarking AI Research Agents: Researchers are investigating the possibility of creating AI research agents capable of performing long-term tasks. (2023-10-08, shares: 50.0)

GoLLIE Annotation Guidelines for ZeroShot Extraction Improvement: Past efforts to use specific information have failed because even the largest models were unable to follow the guidelines. (2023-10-08, shares: 47.0)