Quant Letter: October 2024, Week-4

Weekly (68th Edition)

ArXiv

Finance

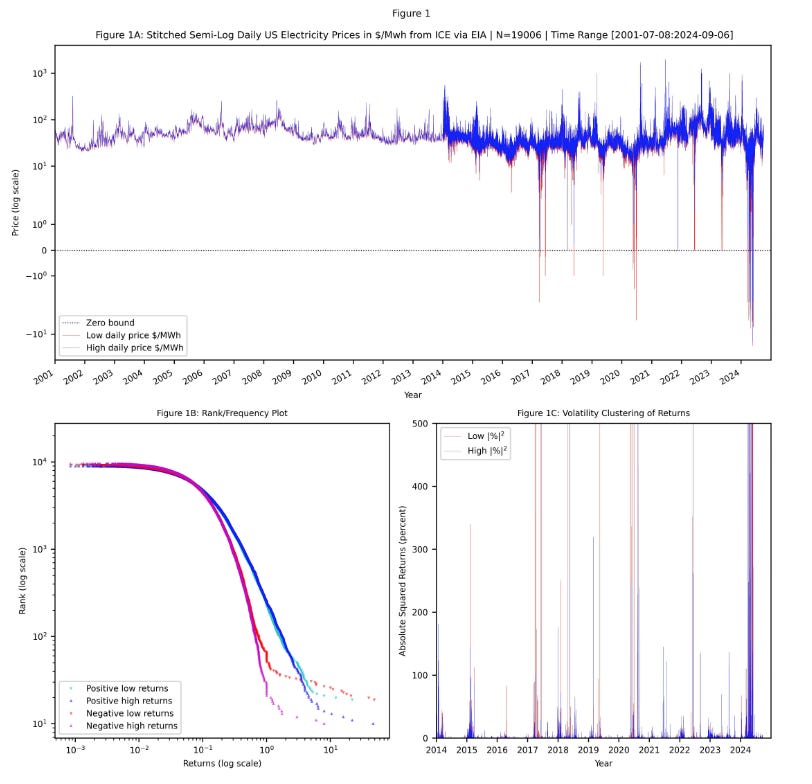

Superelliptical Market Maker: The article discusses a new automated market maker model that can handle both negative and positive asset pricing, useful in electricity, energy, and derivatives markets, and compares it to a replicating market maker. (2024-10-17, shares: 5)

Portfolio Management with Default: The paper explores the optimal portfo…